Understanding TFSA Contribution Limits for 2024: A Canadian Investor's Guide

The Tax- Savings Account (TFSA) remains one of Canada's most powerful investment tools for building wealth. With 2024 bringing new contribution limits and opportunities, understanding how to maximize your TFSA benefits is crucial for every Canadian investor looking to invest and earn tax- returns.

2024 TFSA Contribution Limit

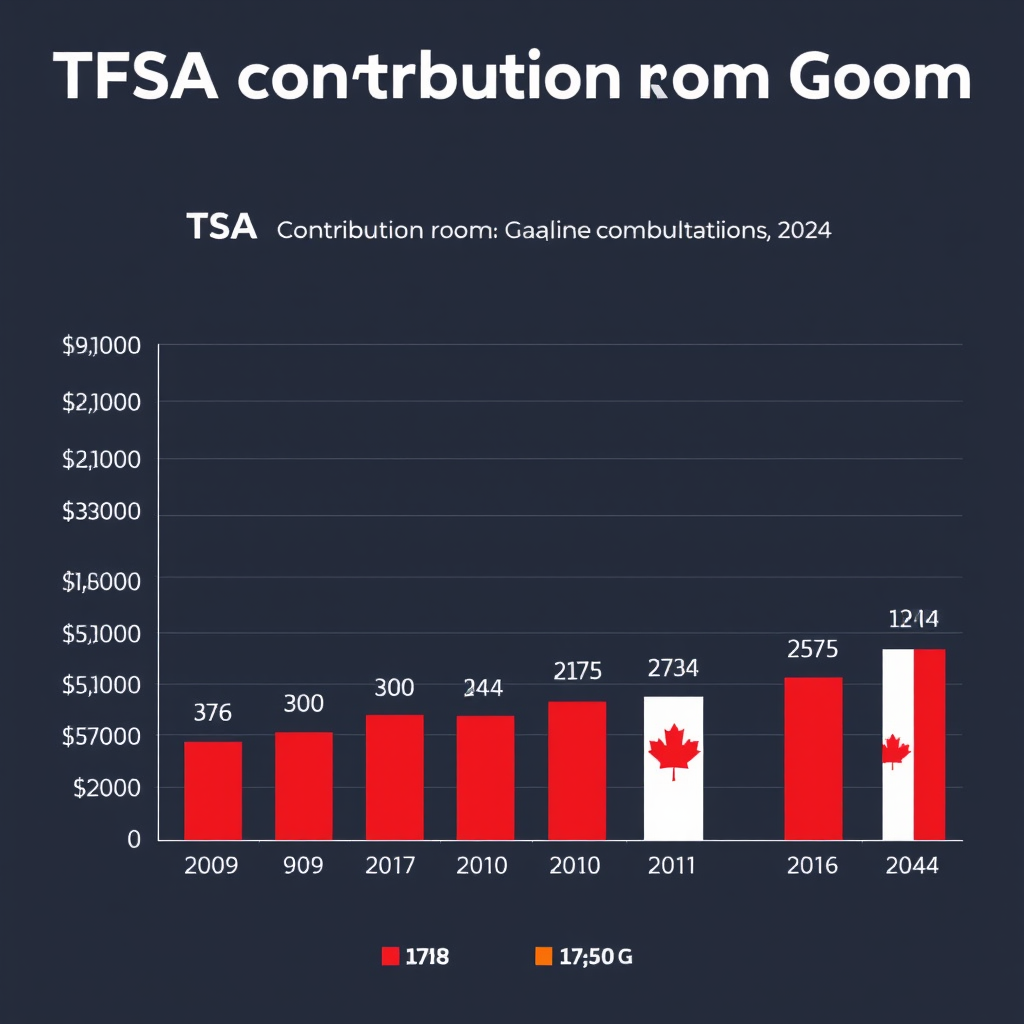

For 2024, the TFSA annual contribution limit is $7,000. This represents an increase from the 2024 limit of $6,500, providing Canadian investors with additional room to invest and earn tax- growth on their investments.

Key 2024 TFSA Facts:

- Annual limit: $7,000

- Cumulative limit since 2009: $95,000

- Unused room carries forward indefinitely

- Withdrawals can be re-contributed the following year

Calculating Your Available Contribution Room

Your TFSA contribution room depends on several factors that every investor should understand to maximize their ability to invest and earn within the account:

Factors Affecting Your Room:

Age and Residency

You must be 18+ and a Canadian resident to accumulate TFSA room. Room starts accumulating from age 18 or when you become a resident, whichever is later.

Previous Contributions

Any amounts you've already contributed reduce your available room. Track all contributions carefully to avoid penalties.

Withdrawals

Withdrawn amounts are added back to your contribution room on January 1st of the following year, allowing you to re-invest and earn on those funds again.

Unused Room

Any unused contribution room carries forward indefinitely, giving you flexibility in your investment timing.

Over-Contribution Penalties: What You Need to Know

Exceeding your TFSA contribution limit results in a penalty tax of 1% per month on the excess amount. This penalty continues until you withdraw the excess or gain additional contribution room.

Penalty Example:

If you over-contribute by $1,000, you'll pay $10 per month (1% of $1,000) until the excess is removed. This penalty can quickly erode your investment gains.

Strategic Tips for Maximizing Your TFSA Benefits

1. Prioritize High-Growth Investments

Since TFSA growth is tax-, focus on investments with higher growth potential. Consider growth stocks, equity ETFs, or emerging market funds to maximize your ability to invest and earn substantial returns.

2. Time Your Contributions Strategically

While you can contribute anytime during the year, consider making contributions early to maximize the time your investments have to grow tax-. Dollar-cost averaging throughout the year can also help reduce market timing risk.

3. Use TFSA for Tax-Inefficient Investments

Hold investments that generate significant taxable income (like REITs, high-dividend stocks, or bonds) in your TFSA to shelter that income from taxes.

Pro Tip for Canadian Investors:

If you're choosing between RRSP and TFSA contributions, consider your current vs. expected retirement tax bracket. TFSA is often better for younger investors or those expecting higher retirement income.

Common TFSA Mistakes to Avoid

Day Trading

Frequent trading in your TFSA may be considered business income by CRA, making your gains taxable and potentially disqualifying the account.

Not Tracking Contributions

Failing to track contributions across multiple accounts can lead to over-contribution penalties. Keep detailed records of all TFSA activity.

Immediate Re-contribution

Re-contributing withdrawn amounts in the same year counts as an over-contribution. Wait until January 1st of the following year.

Using TFSA for Emergency Fund Only

While accessibility is important, using TFSA solely for cash emergency funds wastes its tax- growth potential.

Planning for 2025 and Beyond

The TFSA contribution limit is indexed to inflation and rounded to the nearest $500. Based on current economic conditions, the 2025 limit is expected to remain at $7,000, though this will be confirmed by the Canada Revenue Agency in late 2024.

Long-term Wealth Building Strategy

Maximizing your TFSA contributions annually and allowing compound growth to work over decades can result in substantial tax- wealth. A consistent strategy to invest and earn within your TFSA can potentially generate hundreds of thousands in tax- retirement income.

Conclusion

Understanding and maximizing your TFSA contribution limits is essential for building long-term wealth in Canada. With the 2024 limit of $7,000 and cumulative room of $95,000 for eligible Canadians, the TFSA offers unparalleled opportunities to invest and earn tax- returns.

Remember to track your contributions carefully, avoid over-contribution penalties, and focus on growth-oriented investments to make the most of this powerful investment vehicle. By following these guidelines and staying informed about annual limit changes, you can build a substantial tax- investment portfolio that will serve you well in retirement and beyond.

Disclaimer: This information is for educational purposes only and should not be considered personalized financial advice. Consult with a qualified financial advisor or tax professional for advice specific to your situation.