Real Estate Investment Trusts (REITs) in Canada: Opportunities and Risks

Real Estate Investment Trusts (REITs) have become an increasingly popular way for Canadian investors to gain exposure to real estate markets without the complexities of direct property ownership. With the potential to earn steady income and benefit from property appreciation, REITs offer unique opportunities in today's investment landscape.

Understanding the Canadian REIT Market

Canada's REIT market has evolved significantly over the past two decades, offering investors access to a diverse range of property types and geographic regions. The Canadian REIT sector is well-regulated and provides transparency that helps investors make informed decisions about their portfolios.

The market encompasses various sectors, each with distinct characteristics that can help investors diversify their real estate exposure while maintaining liquidity through public market trading.

Types of Canadian REITs: Diversification Opportunities

Residential REITs

Residential REITs focus on apartment buildings, condominiums, and other residential properties. These trusts benefit from Canada's growing population and urbanization trends, particularly in major cities like Toronto, Vancouver, and Montreal. Residential REITs typically offer stable cash flows through rental income, making them attractive for investors seeking regular distributions.

Commercial REITs

Commercial REITs invest in office buildings, retail centers, and mixed-use developments. These properties often feature longer lease terms with established tenants, providing predictable income streams. However, they may face challenges from changing work patterns and e-commerce trends that affect traditional retail and office space demand.

Industrial REITs

Industrial REITs own warehouses, distribution centers, and manufacturing facilities. The growth of e-commerce and supply chain optimization has increased demand for industrial properties, making this sector particularly attractive for investors looking to capitalize on logistics and distribution trends.

Key Benefits of REIT Diversification

- Access to different property sectors without direct ownership

- Professional management and maintenance

- Liquidity through public market trading

- Regular income distributions

- Geographic diversification across Canadian markets

Market Trends Shaping Canadian REITs

Several key trends are currently influencing the Canadian REIT market, creating both opportunities and challenges for investors looking to invest and earn returns from real estate exposure.

Population Growth and Urbanization

Canada's continued population growth, driven by immigration and internal migration to urban centers, supports demand for residential and commercial properties. This demographic trend particularly benefits REITs with exposure to major metropolitan areas where housing demand remains strong.

E-commerce and Industrial Demand

The shift toward online shopping has increased demand for warehouse and distribution facilities, benefiting industrial REITs. This trend has accelerated since 2020 and continues to drive growth in the logistics real estate sector.

Hybrid Work Impact

Changes in work patterns have affected office space demand, with some commercial REITs adapting by focusing on flexible workspace solutions and mixed-use developments that combine residential, retail, and office components.

Interest Rate Impacts on REIT Performance

Interest rates play a crucial role in REIT valuation and performance. Understanding this relationship is essential for investors considering REITs as part of their portfolio strategy.

Rising Rate Environment

- Higher borrowing costs for property acquisitions

- Potential pressure on property valuations

- Competition from fixed-income investments

- Need for stronger operational performance

Falling Rate Environment

- Lower financing costs for expansion

- Increased property valuations

- Higher relative yield attractiveness

- Potential for capital appreciation

Successful REIT investors monitor interest rate trends and consider how rate changes might affect different property sectors and individual REIT strategies.

Evaluating REIT Performance for Your Portfolio

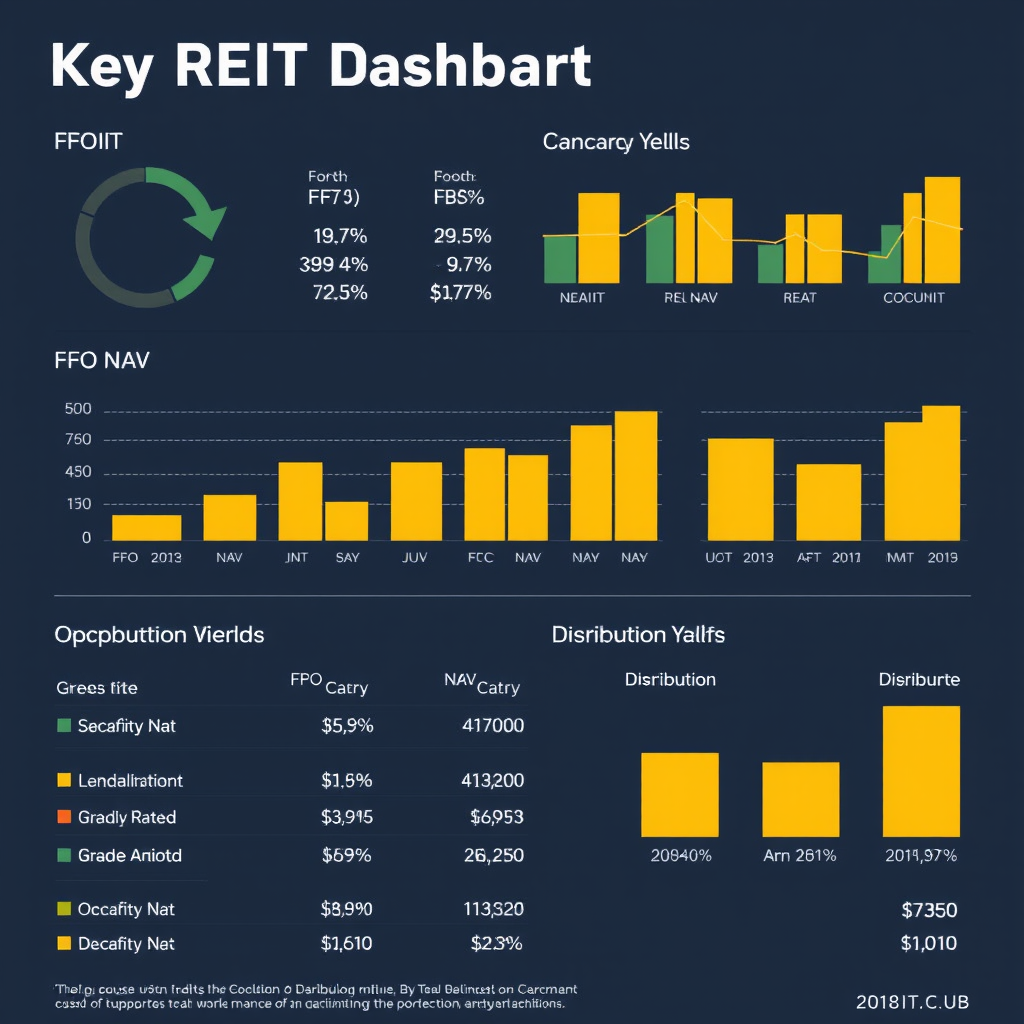

Key Performance Metrics

Funds From Operations (FFO)

FFO measures a REIT's cash flow from operations, providing insight into the sustainability of distributions and the trust's operational efficiency.

Net Asset Value (NAV)

NAV represents the estimated market value of a REIT's properties minus liabilities, helping investors assess whether shares are trading at a premium or discount.

Occupancy Rates

High occupancy rates indicate strong demand for the REIT's properties and effective property management, supporting stable income generation.

Distribution Yield

The distribution yield shows the annual income return relative to the share price, but investors should also consider distribution sustainability.

Portfolio Integration Strategies

When adding REITs to your investment portfolio, consider how they complement your existing holdings. REITs can provide diversification benefits, inflation protection, and income generation, but they should be balanced with other asset classes based on your risk tolerance and investment objectives.

Due Diligence Checklist

- Review property portfolio quality and geographic diversification

- Analyze tenant quality and lease expiration schedules

- Assess management team experience and track record

- Evaluate debt levels and financing structure

- Compare performance metrics to sector peers

- Consider market conditions affecting specific property types

Risk Considerations for REIT Investors

While REITs offer attractive opportunities to invest and earn income from real estate, they also carry specific risks that investors should understand before making investment decisions.

Market and Economic Risks

REITs are sensitive to economic cycles, interest rate changes, and real estate market conditions. Economic downturns can affect occupancy rates, rental income, and property values, impacting REIT performance and distributions.

Sector-Specific Risks

Different REIT sectors face unique challenges. Retail REITs may struggle with e-commerce competition, office REITs with changing work patterns, and residential REITs with rent control regulations or housing market volatility.

Liquidity and Volatility

While publicly traded REITs offer liquidity advantages over direct real estate ownership, they can experience significant price volatility, especially during market stress periods or when interest rates change rapidly.

Important Risk Reminder

REIT investments should be evaluated within the context of your overall portfolio and risk tolerance. Consider consulting with a financial advisor to determine appropriate allocation levels and ensure REITs align with your investment objectives.

Looking Ahead: The Future of Canadian REITs

The Canadian REIT market continues to evolve, with new opportunities emerging from demographic trends, technological advances, and changing consumer preferences. Investors who stay informed about these developments can better position their portfolios for long-term success.

Emerging Opportunities

Areas such as data centers, healthcare facilities, and sustainable building developments represent growing segments within the REIT market. These sectors may offer attractive growth prospects as technology adoption increases and environmental considerations become more important.

Sustainability and ESG Focus

Environmental, social, and governance (ESG) factors are becoming increasingly important in real estate investment decisions. REITs that prioritize energy efficiency, sustainable building practices, and social responsibility may attract more investor interest and potentially command premium valuations.

As the Canadian economy continues to grow and evolve, REITs remain an important tool for investors seeking real estate exposure, income generation, and portfolio diversification. Success in REIT investing requires ongoing research, careful selection, and regular portfolio review to ensure investments continue to meet your financial objectives.