ETF vs Mutual Funds: Which Investment Vehicle Suits Canadian Investors Better?

When it comes to building a diversified investment portfolio in Canada, two popular options dominate the landscape: Exchange-Traded Funds (ETFs) and mutual funds. Both offer unique advantages and potential drawbacks that can significantly impact your ability to invest and earn returns over time.

Understanding the fundamental differences between these investment vehicles is crucial for Canadian investors looking to maximize their returns while minimizing costs and tax implications. This comprehensive analysis will help you make an informed decision based on your investment goals, risk tolerance, and financial situation.

Understanding the Basics: ETFs vs Mutual Funds

Exchange-Traded Funds (ETFs)

ETFs are investment funds that trade on stock exchanges like individual stocks. They typically track an index, commodity, bonds, or a basket of assets, offering instant diversification and transparency.

- Trade throughout market hours

- Generally lower management fees

- Tax-efficient structure

- Transparent holdings

Mutual Funds

Mutual funds pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities, managed by professional fund managers.

- Professional active management

- Automatic reinvestment options

- Fractional share purchases

- Systematic investment plans

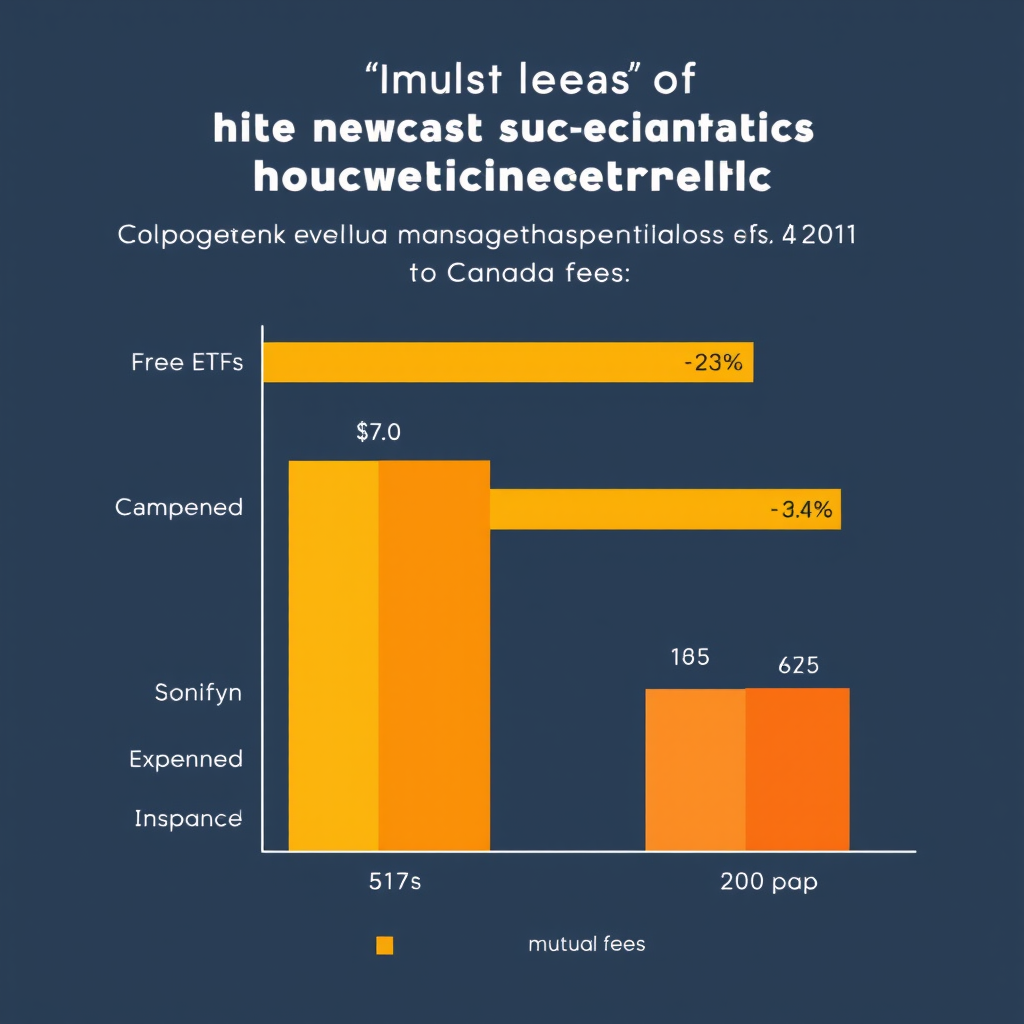

Cost Analysis: Management Fees and Expenses

One of the most significant factors affecting your ability to invest and earn substantial returns is the cost structure of your chosen investment vehicle.

| Cost Factor | ETFs | Mutual Funds |

|---|---|---|

| Management Expense Ratio (MER) | 0.05% - 0.75% | 0.5% - 2.5% |

| Trading Commissions | $4.95 - $9.95 per trade | Often commission- |

| Sales Charges | None | Up to 5.75% (front-end load) |

| Redemption Fees | None | Possible (back-end load) |

Cost Impact Example

On a $10,000 investment over 20 years with 7% annual returns, a 2% MER mutual fund would cost you approximately $8,700 more than a 0.25% MER ETF, significantly impacting your ability to earn maximum returns.

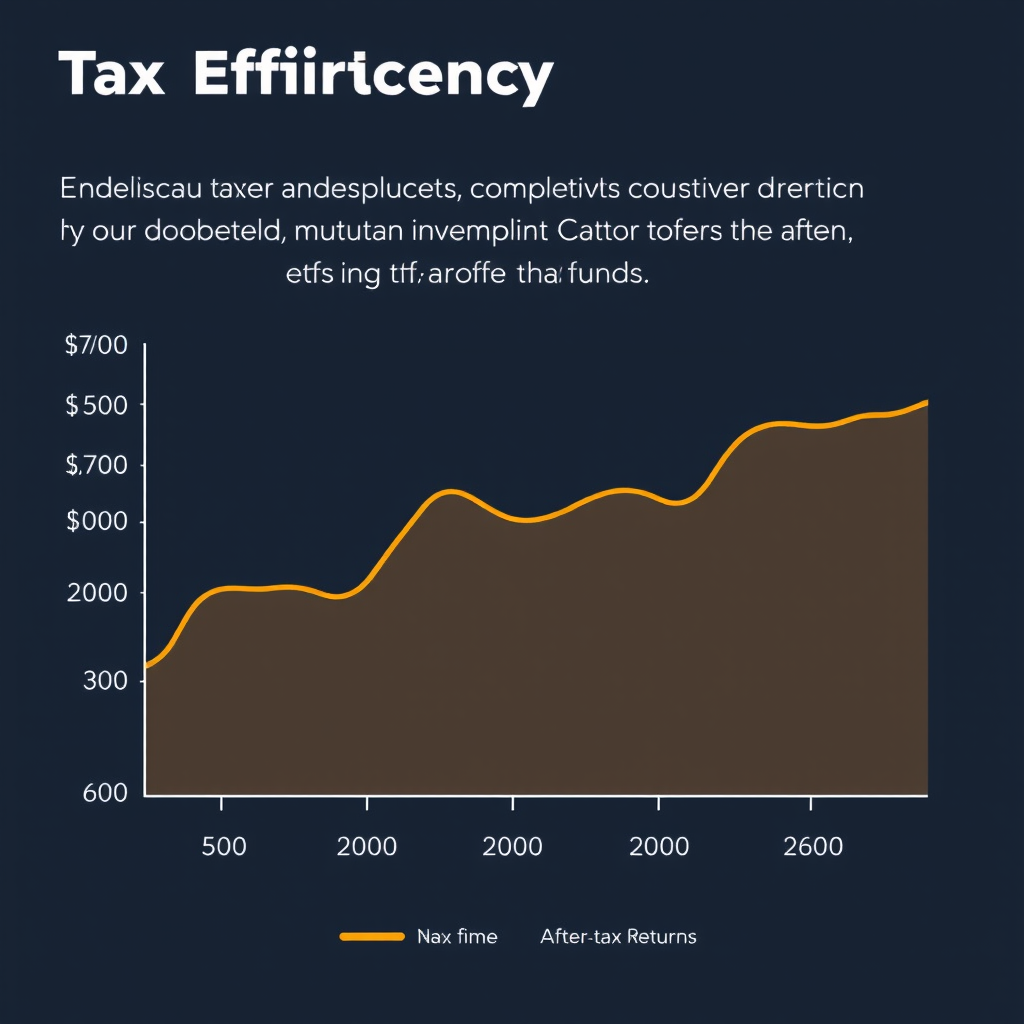

Tax Efficiency: A Canadian Perspective

Tax efficiency plays a crucial role in your net investment returns, especially for Canadian investors dealing with capital gains, dividends, and foreign withholding taxes.

ETF Tax Advantages

- In-kind redemptions: Minimize capital gains distributions

- Lower turnover: Reduced taxable events

- Tax-loss harvesting: Easier to implement

- Foreign withholding tax: Better treatment for US holdings

Mutual Fund Tax Considerations

- Capital gains distributions: Often unavoidable

- Higher turnover: More frequent taxable events

- Less control: Limited tax-loss harvesting options

- Timing issues: Year-end distributions can be problematic

Liquidity and Trading Flexibility

The ability to quickly buy or sell your investments can be crucial during market volatility or when you need to rebalance your portfolio to maintain optimal returns.

ETF Liquidity Advantages

- Real-time trading: Buy and sell during market hours

- Intraday pricing: Know exact price before trading

- Market orders: Various order types available

- No minimum holding periods: Trade anytime

- Stop-loss orders: Risk management tools available

Mutual Fund Trading Characteristics

- End-of-day pricing: NAV calculated after market close

- T+1 settlement: Trades execute next business day

- No intraday trading: Limited timing flexibility

- Minimum investment amounts: Often $500-$1,000 initial

- Systematic plans: Automatic investment options

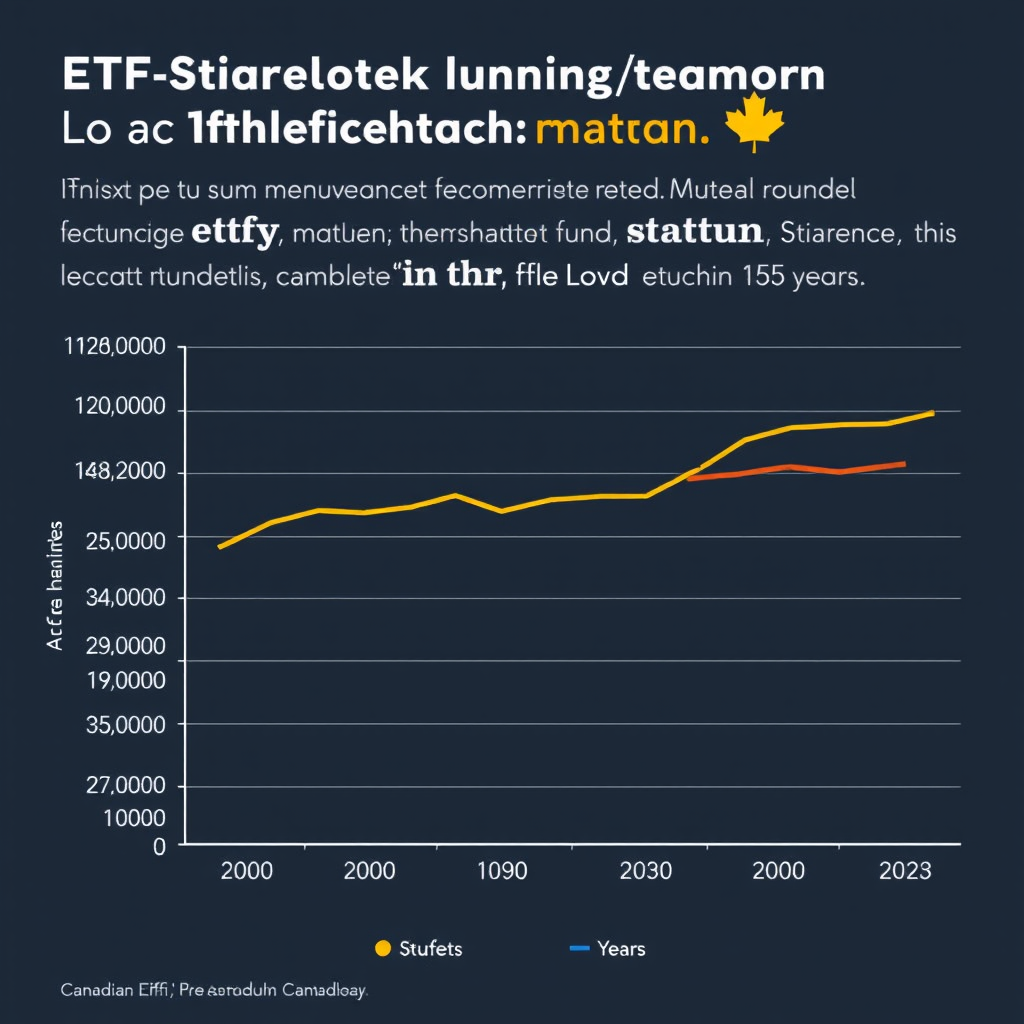

Performance Comparison: Active vs Passive Management

Understanding how these investment vehicles perform over time is essential for Canadian investors looking to invest and earn competitive returns.

Performance Reality Check

According to SPIVA Canada reports, approximately 85% of Canadian equity mutual funds underperformed their benchmark indices over a 15-year period, highlighting the challenge of active management in delivering superior returns.

ETF Performance Factors

- Closely track benchmark indices

- Lower fees enhance net returns

- Consistent, predictable performance

- Market return capture efficiency

Mutual Fund Performance Factors

- Potential for outperformance

- Professional management expertise

- Active risk management

- Higher fees impact net returns

Decision Framework: Which Option Suits Your Investment Profile?

ETFs May Be Better If You:

- Prioritize low costs and tax efficiency

- Want transparency in holdings

- Prefer passive index investing

- Need trading flexibility

- Have larger investment amounts

- Are comfortable with self-directed investing

- Want to invest and earn with minimal fees

Mutual Funds May Be Better If You:

- Value professional active management

- Want automatic investment plans

- Prefer fractional share investing

- Need comprehensive financial advice

- Have smaller regular contributions

- Want specialized sector expertise

- Prefer set-and-forget investing

Practical Examples for Canadian Investors

Scenario 1: Young Professional

Profile: 28-year-old, $50,000 annual income, $25,000 to invest

Recommendation: ETF portfolio with broad market exposure

Rationale: Lower costs maximize long-term growth potential, tax efficiency important for taxable accounts

Scenario 2: Pre-Retirement Investor

Profile: 55-year-old, $100,000 annual income, $500,000 portfolio

Recommendation: Mix of ETFs and actively managed mutual funds

Rationale: ETFs for core holdings, mutual funds for specialized strategies and professional guidance

Key Considerations for Canadian Investors

Tax-Advantaged Accounts

Both ETFs and mutual funds work well in RRSPs and TFSAs, where tax efficiency differences are less important

Currency Hedging

Consider currency-hedged options for foreign exposure to reduce exchange rate risk in your Canadian portfolio

Diversification

Both vehicles offer excellent diversification opportunities across Canadian and international markets

Making Your Decision

The choice between ETFs and mutual funds isn't necessarily an either-or decision. Many successful Canadian investors use both vehicles strategically within their portfolios to optimize their ability to invest and earn returns.

Final Recommendation

For most Canadian investors, a core portfolio of low-cost ETFs supplemented by carefully selected mutual funds for specialized strategies often provides the balance of cost efficiency, diversification, and professional management where needed.

Remember that your investment choice should align with your financial goals, risk tolerance, investment timeline, and comfort level with self-directed investing. Consider consulting with a qualified financial advisor to determine the optimal mix for your specific situation and maximize your potential to invest and earn substantial returns over time.